South Korea Hits $18B in Crypto Trading, Beats Stocks

Cryptocurrency trading volumes in South Korea surged to $18 billion on December 2, exceeding stock market volumes by 22%, according to 10x Research.

South Korea’s crypto trading activity surpassed its stock market, which recorded 539.6 billion won ($385 million) in foreign inflows on December 2, according to Bloomberg reports. This surge is indebted to the retail enthusiasm in veteran tokens such as Hedera (HBAR), Dogecoin (DOGE), Stellar (XLM) and Ripple (XRP), reported 10x Research.

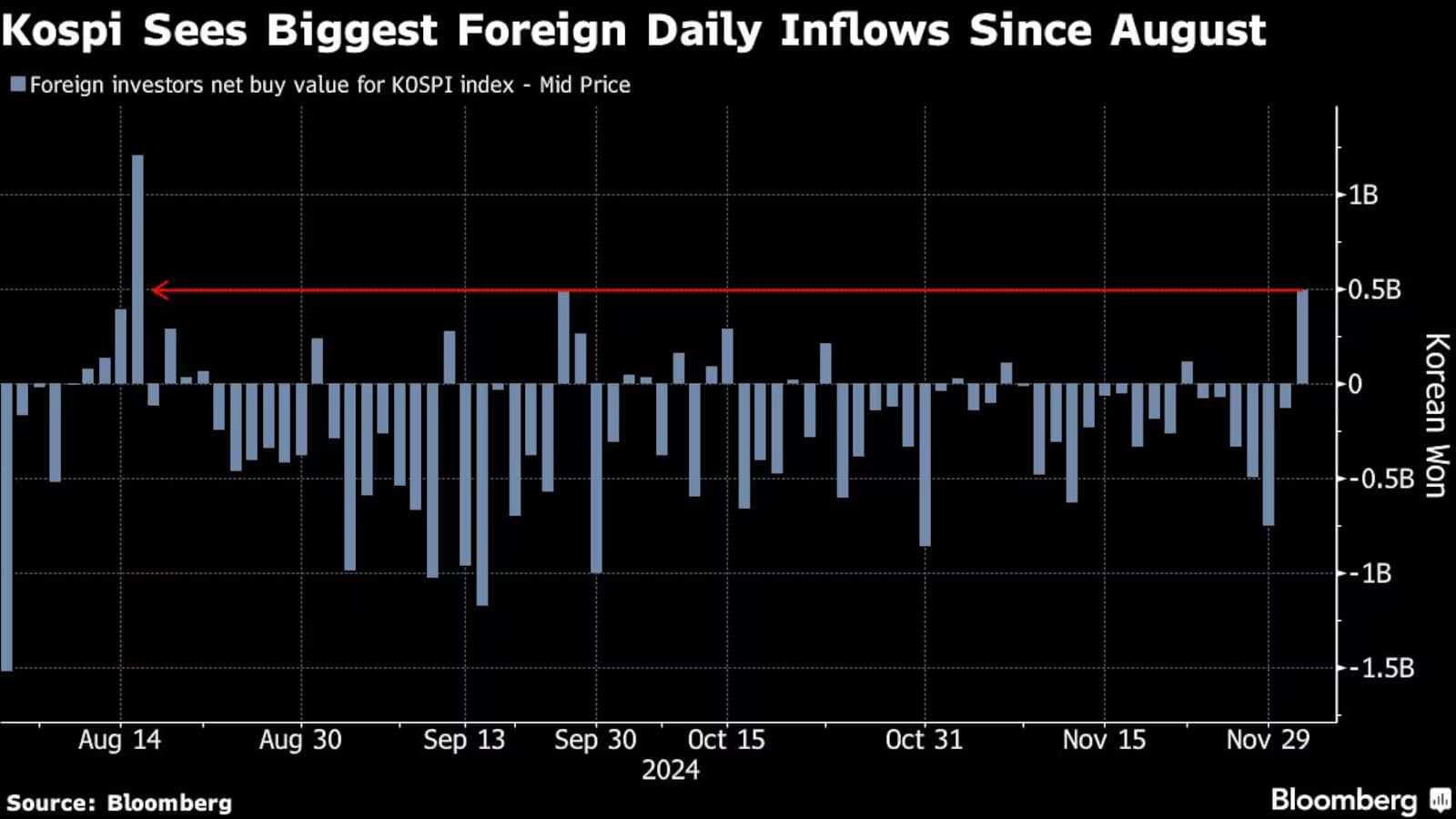

Contrastingly, South Korea’s stock market also remained active, with its largest inflow of foreign funds in three months. Global funds bought $385 million of Kospi Index shares on Dec. 2, which resulted in a 1.9% gain for the benchmark index after two days of declines. Seo Sang-young, a strategist at Mirae Asset Securities Co., reported that the inflows were driven by improved U.S. economic indicators, which included the ISM manufacturing new orders gauge, which entered the expansion territory for the first time in eight months, bringing investor’s confidence back in the South Korean export-driven economy.

Altcoins in action

XRP dominated the trading activity by recording a $6.3 billion inflow, closely followed by DOGE, which recorded a $1.6 billion inflow and XLM with $1.3 billion. Ethereum Name Service (ENS) and HBAR also saw prominent trading activity, indicating that altcoins have been a major contributor to the influx in trading activity. XRP reached its yearly high at $2.80 and has now become the third largest cryptocurrency, surpassing Tether (USDT), after reaching $42.65 billion in global trading volume in the last 24 hours.

This #altcoin is Breaking Out – Catching the Next Wave

👇1-10) In the past few weeks, several cryptocurrencies have doubled in value, and our Trading Signals successfully identified two of them. @tezos has risen +96%, while @enjin is up +91%, both triggered by buy signals on… pic.twitter.com/qOiQfMPrWD

— 10x Research (@10x_Research) December 3, 2024

Markus Thielen, the founder and CEO of 10x Research, observed that altcoin trade volumes are continuing to dominate the market. In contrast, Bitcoin funding rates are steady at 15%, quoting, “The action is clearly in the altcoin market”. This is further supported by CoinMarketCap’s Altcoin season index, which indicates the dominance of altcoins over Bitcoin, which stands at 83%.