Solana’s TVL down by 30% – Can network recover after LIBRA scandal?

- Solana’s TVL fell below $10 billion due to the LIBRA rug pull and liquidity outflows

- Recovery to $10.3 billion still highlighted a nearly 30% decline since mid-January

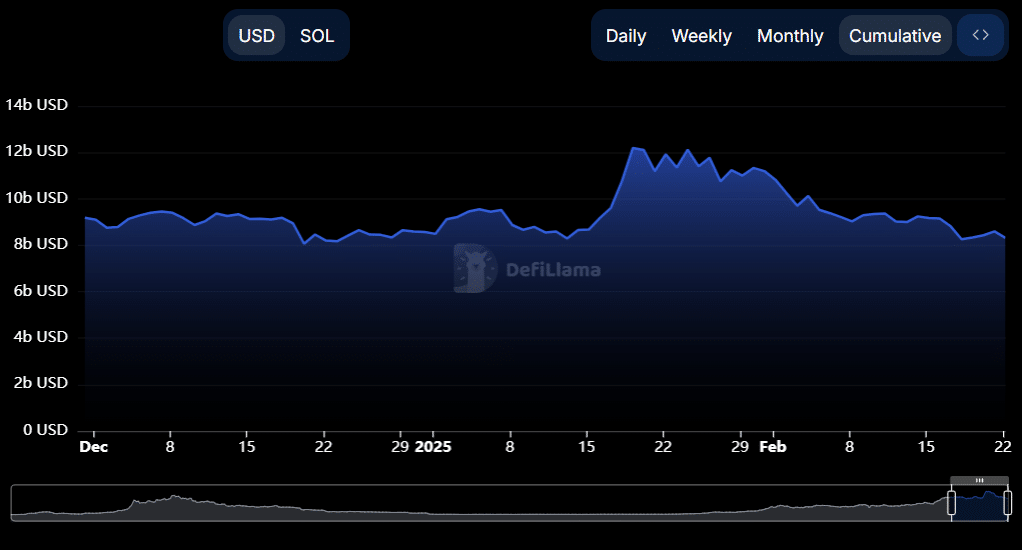

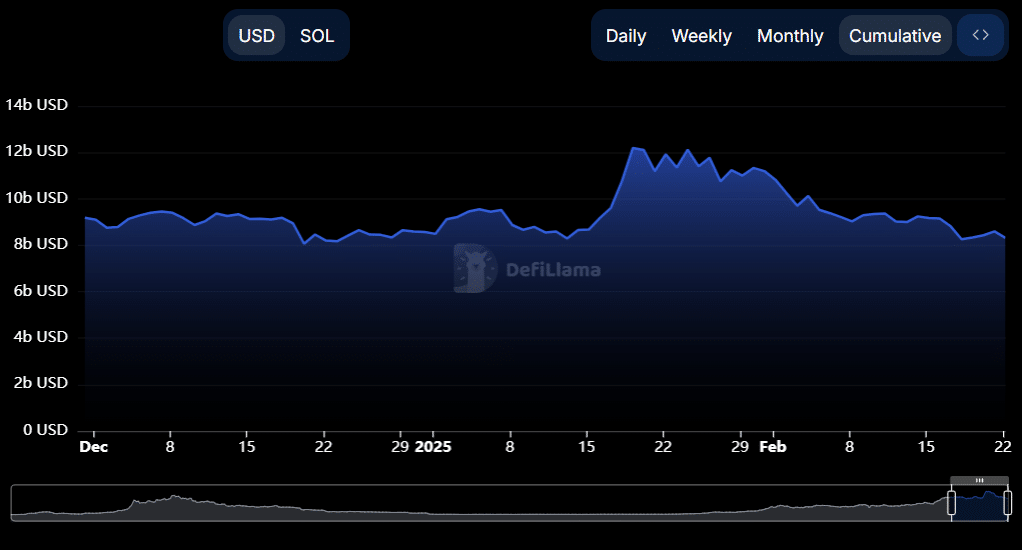

Solana’s [SOL] Total Value Locked recently hit a new low of $9.90 billion, marking an unfortunate milestone for the network. This bout of depreciation, largely attributed to the fallout from the LIBRA rug pull, has fueled concerns over the stability of Solana’s DeFi ecosystem.

Although the same has recovered somewhat to hit $10.3 billion, this still represents a nearly 30% drop since mid-January. Needless to say, this has prompted questions about the network’s long-term health and growth.

With Solana facing these challenges, all eyes are on how this may impact SOL’s price and broader market sentiment.

Solana’s TVL hits new lows

Solana’s TVL recorded a sharp decline on the charts, with the latest drop pushing it below $10 billion for the first time since November 2024. This decline follows a broader trend of fluctuating liquidity within Solana’s DeFi ecosystem, a pattern seen during past downturns triggered by protocol exploits and market-wide contractions.

Historically, significant TVL declines in Solana have coincided with major sell-offs in SOL’s price. Especially as investor confidence wanes in response to ecosystem instability. In fact, recent data highlighted a steep drop in late January 2025, one largely attributed to the aftermath of the LIBRA rug pull.

While Solana’s TVL previously hovered near $12 billion, the nearly 30% drawdown within a month is a stark reminder of the fragility of Solana’s DeFi sector. It’s also a comment on its ongoing struggle to retain locked capital.

Security concerns persist amid LIBRA fallout

Despite the decline, however, Solana’s TVL rebounded slightly to $10.3 billion, indicating some level of capital inflows.

However, the LIBRA rug pull has caused lasting damage, exacerbating concerns about security and investor trust in Solana-based DeFi projects. The sudden collapse of LIBRA drained liquidity from multiple protocols, triggering forced liquidations and further dampening participation.

Source: DeFiLlama

While TVL surged briefly in early February, it struggled to sustain any momentum, signaling that investor confidence remains shaky.

These broader implications extend beyond Solana’s DeFi sector. SOL’s price action could remain volatile as market participants reassess the ecosystem’s risk. If Solana fails to restore faith in its DeFi security and governance, the recent recovery may be short-lived, leaving the network vulnerable to further capital flight.

Solana’s price outlook

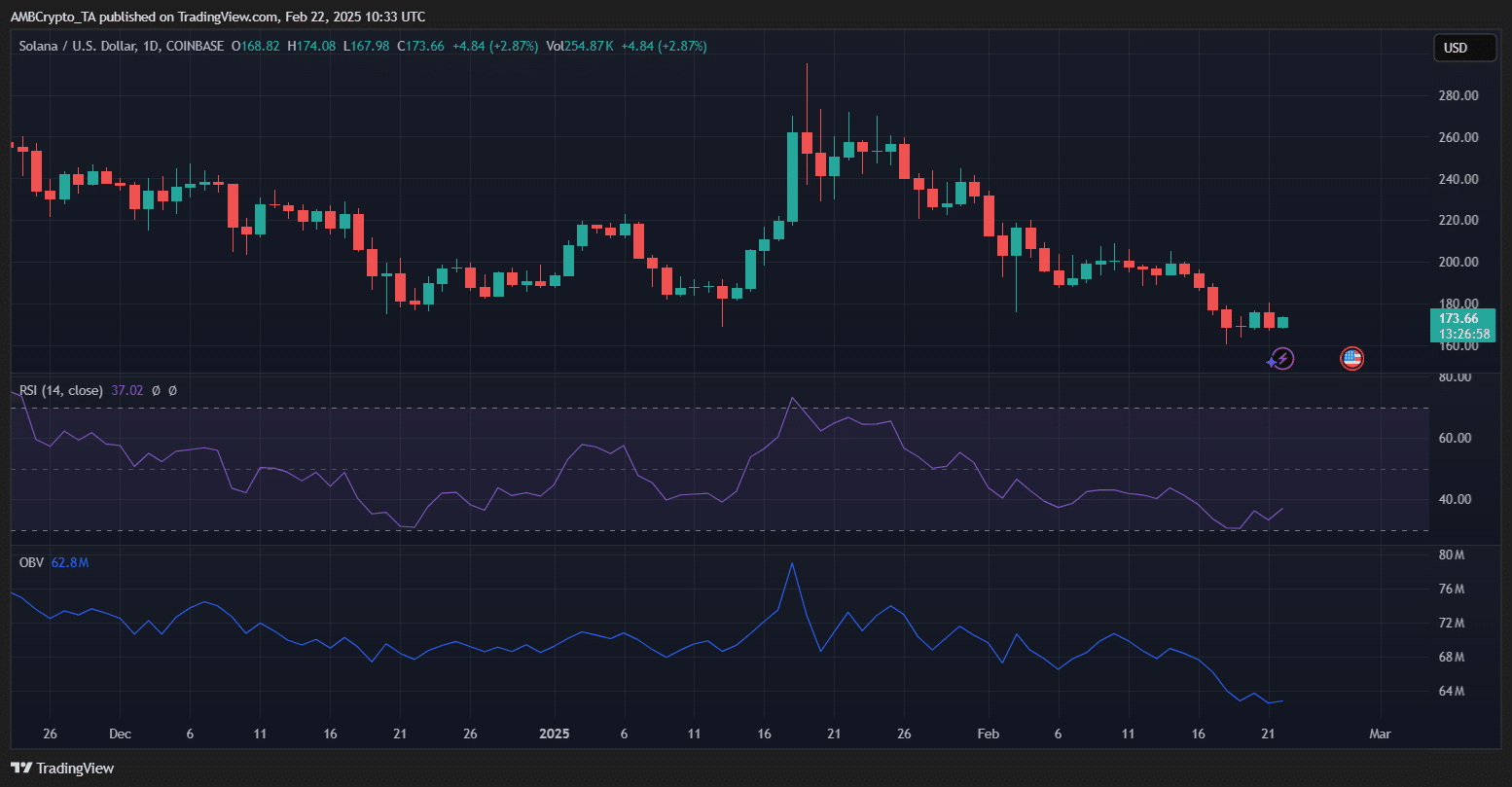

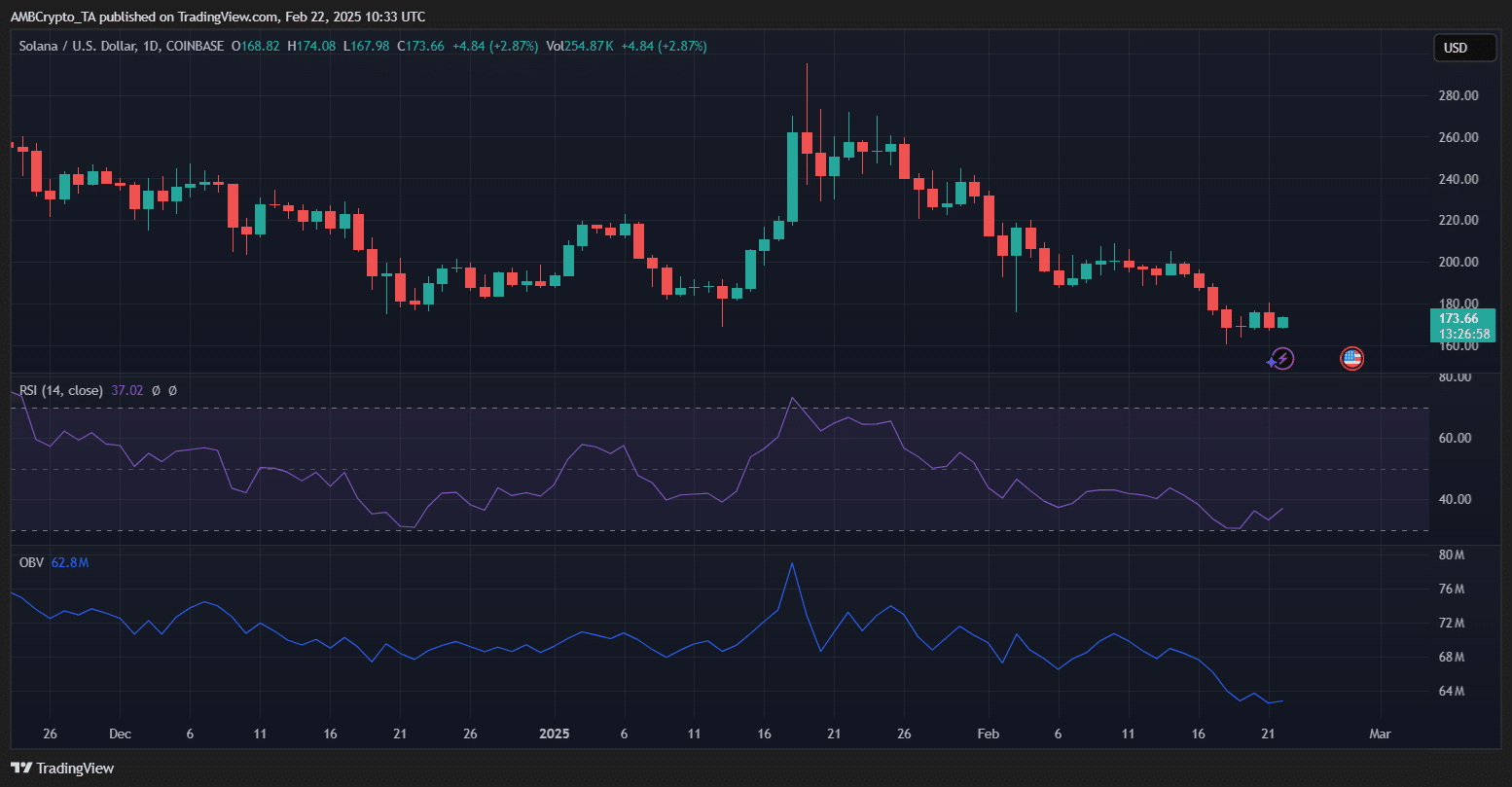

The drop in Solana’s TVL appears to have contributed to SOL’s latest bearish trend. The price chart revealed SOL trading at $173.66 at press time, following intraday gains of 2.87%.

However, the broader trend remains south-bound. Since peaking above $260 earlier this year, SOL has steadily fallen, mirroring the liquidity outflows from its DeFi ecosystem. The RSI at 37.02 suggested that selling pressure has been dominant in recent weeks.

Additionally, the OBV at 62.8M pictured a decline – A sign of reduced buying momentum.

Source: TradingView

The LIBRA fiasco’s impact on TVL likely triggered a wave of investor uncertainty, leading to sustained sell-offs.

Historically, SOL’s price has reacted negatively to liquidity contractions in its ecosystem, and this time is no different. While the recent RSI uptick hinted at a potential short-term rebound, SOL remains at risk unless DeFi confidence is restored.

If TVL continues to stagnate, Solana could struggle to reclaim the $200-resistance level in the near term.