Canary’s Litecoin ETF listed on DTCC – Will trading begin soon?

- Canary Capital Litecoin ETF filing could begin trading soon, per analyst.

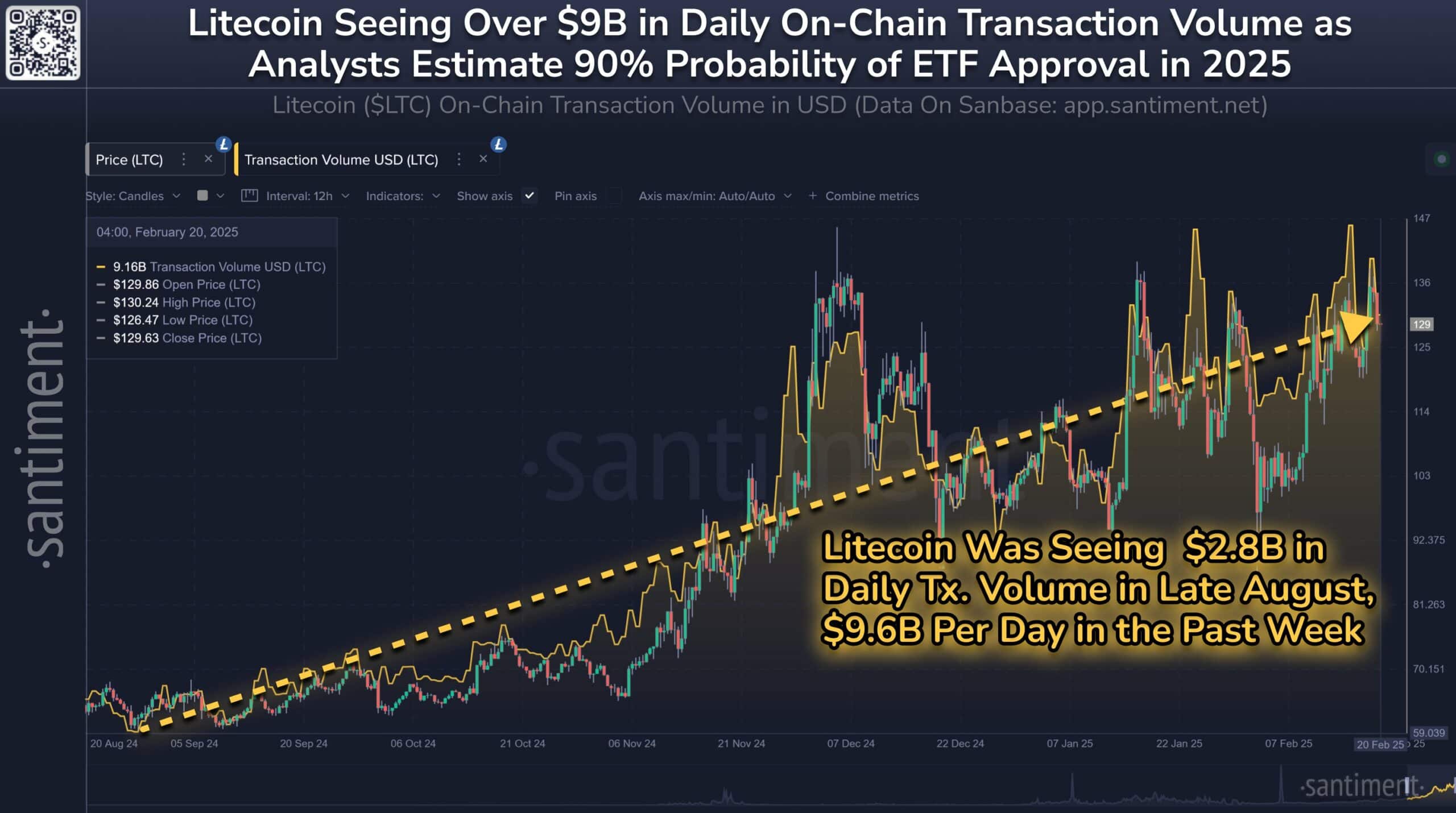

- Speculative interest in the altcoin has increased, with nearly $10B in on-chain volume.

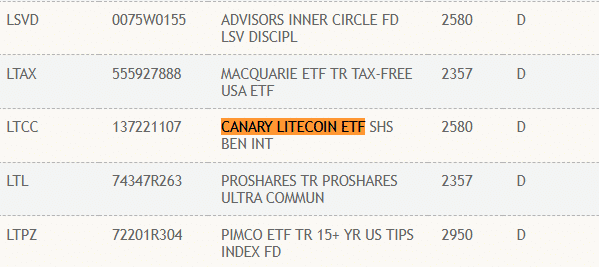

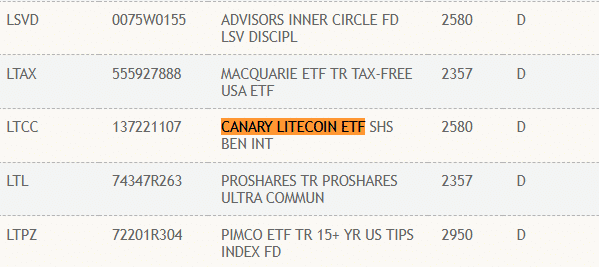

Canary Capital’s proposed Litecoin[LTC] ETF has been listed on the Depository Trust and Clearing Corporation (DTCC), prompting analysts to speculate that the product could begin trading soon.

Bloomberg ETF analyst Eric Balchunas maintained approval odds for LTC ETF at 90%. However, he noted that the DTCC listing was a preparation for an ETF launch, but not an outright approval signal.

Source: X

LTC ETF speculation

On his part, Nate Geraci of ETF Store echoed the same sentiment but added that the product could begin trading soon, citing similarity to the BTC ETF approval process. He said,

“Litecoin ETF “listed” on DTCC. Having flashbacks to spot BTC ETFs…This doesn’t mean anything, but I also think highly likely that LTC ETF is coming to a brokerage near you.”

For those unfamiliar, the Canary LTC ETF 194-b filing entered the Federal Register on 4th February.

The SEC could approve or dismiss the filing within the next 45–90 days after listing on the Federal Register. That would translate to a likely SEC decision around late March or early May.

Additionally, Grayscale and CoinShares filed similar LTC ETF applications and have been acknowledged by the regulator.

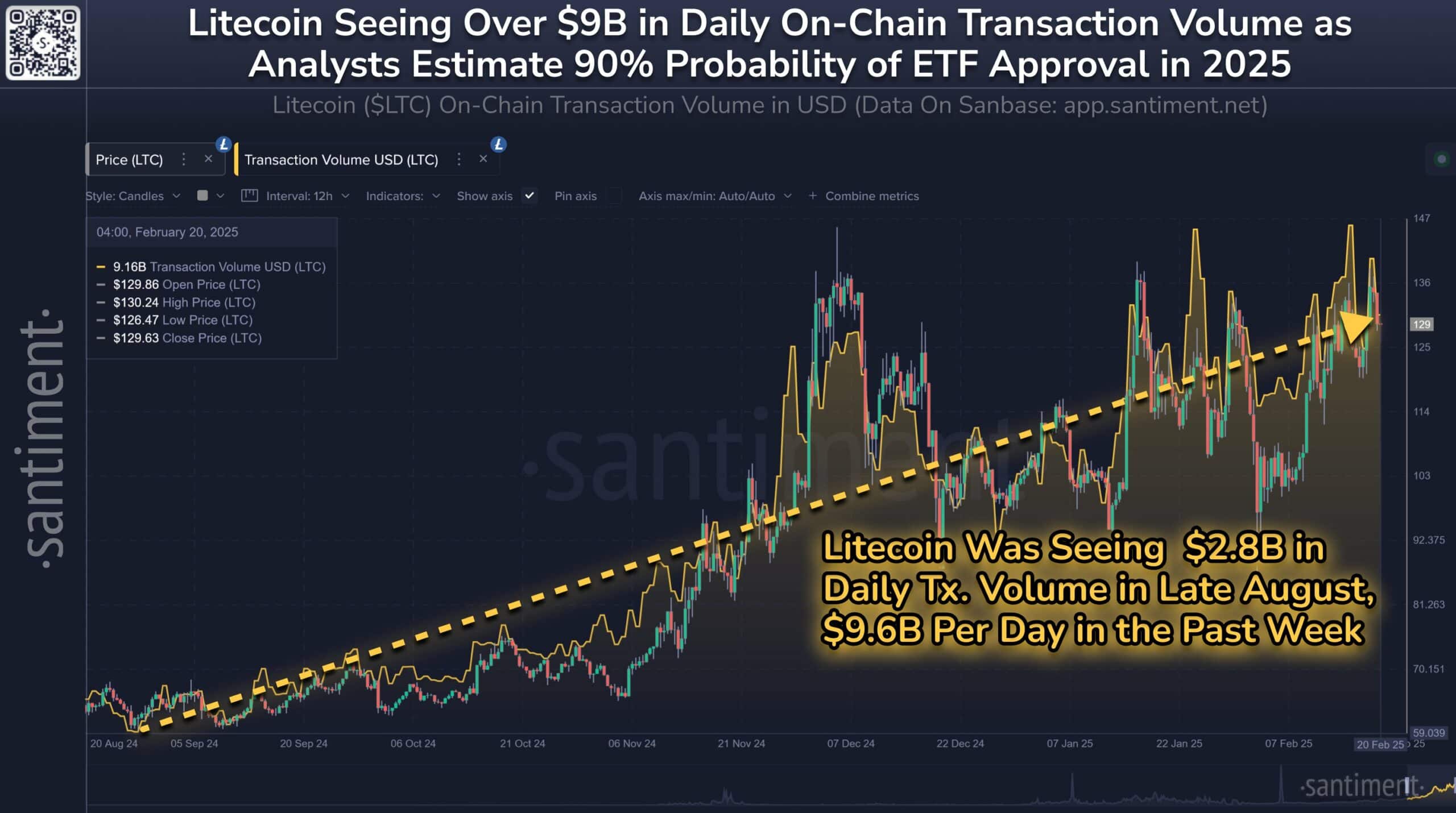

Interestingly, traders have jumped on LTC amid the ETF speculation. According to Santiment, LTC’s market cap surged 46% while daily trading volume surged nearly to $10B in the past week alone.

“Part of this growth comes from its strong rise in network utility, which has been processing $9.6B in daily transaction volume over the past 7 days.”

Source: Santiment

Speculative interest was observed in the Futures markets, where traders use leverage to capitalize on opportunities.

According to Coinglass, LTC’s Open Interest (OI) rates increased to $869M. During the 2021 cycle peak, the OI surged to $1B, suggesting current speculative interest is close to last cycle highs.

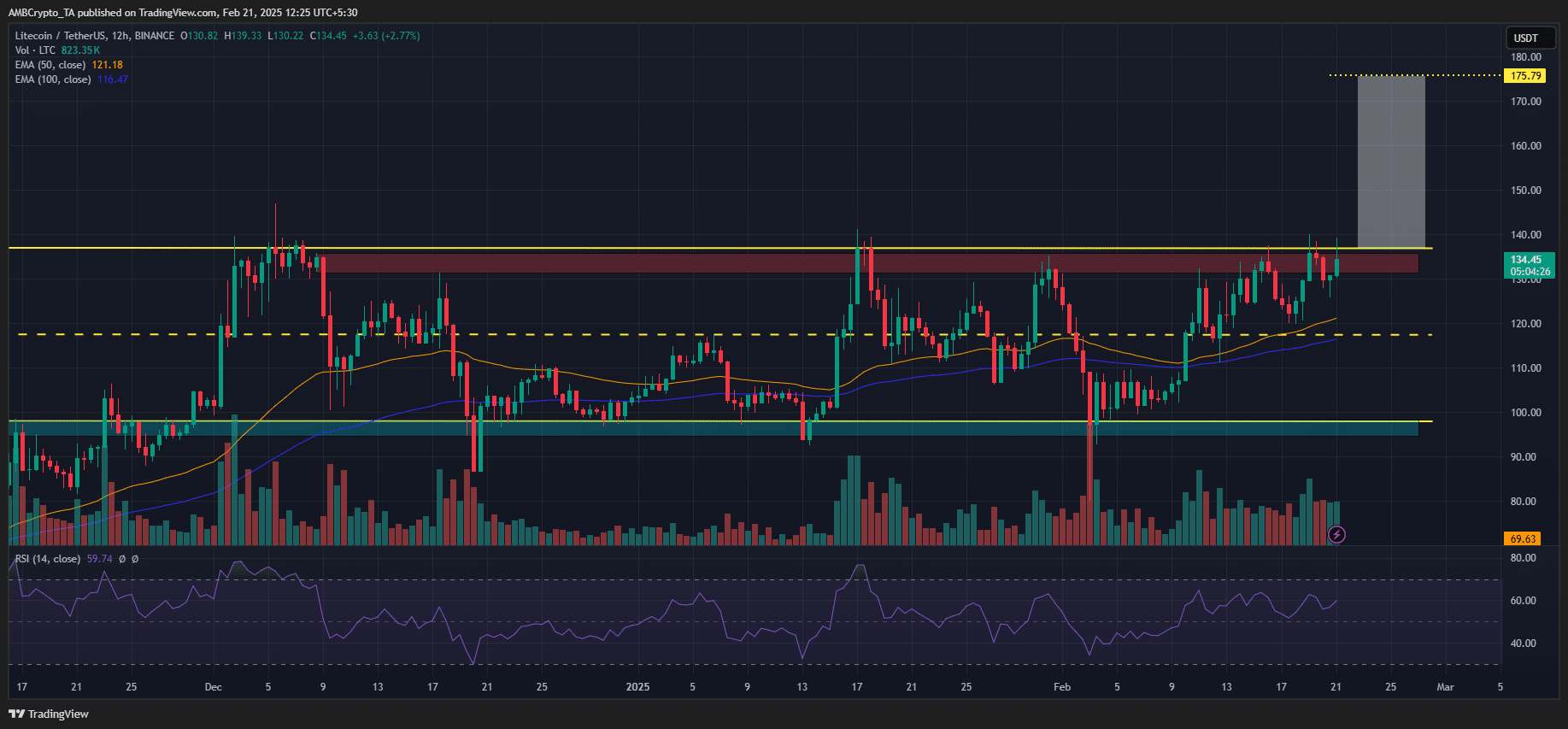

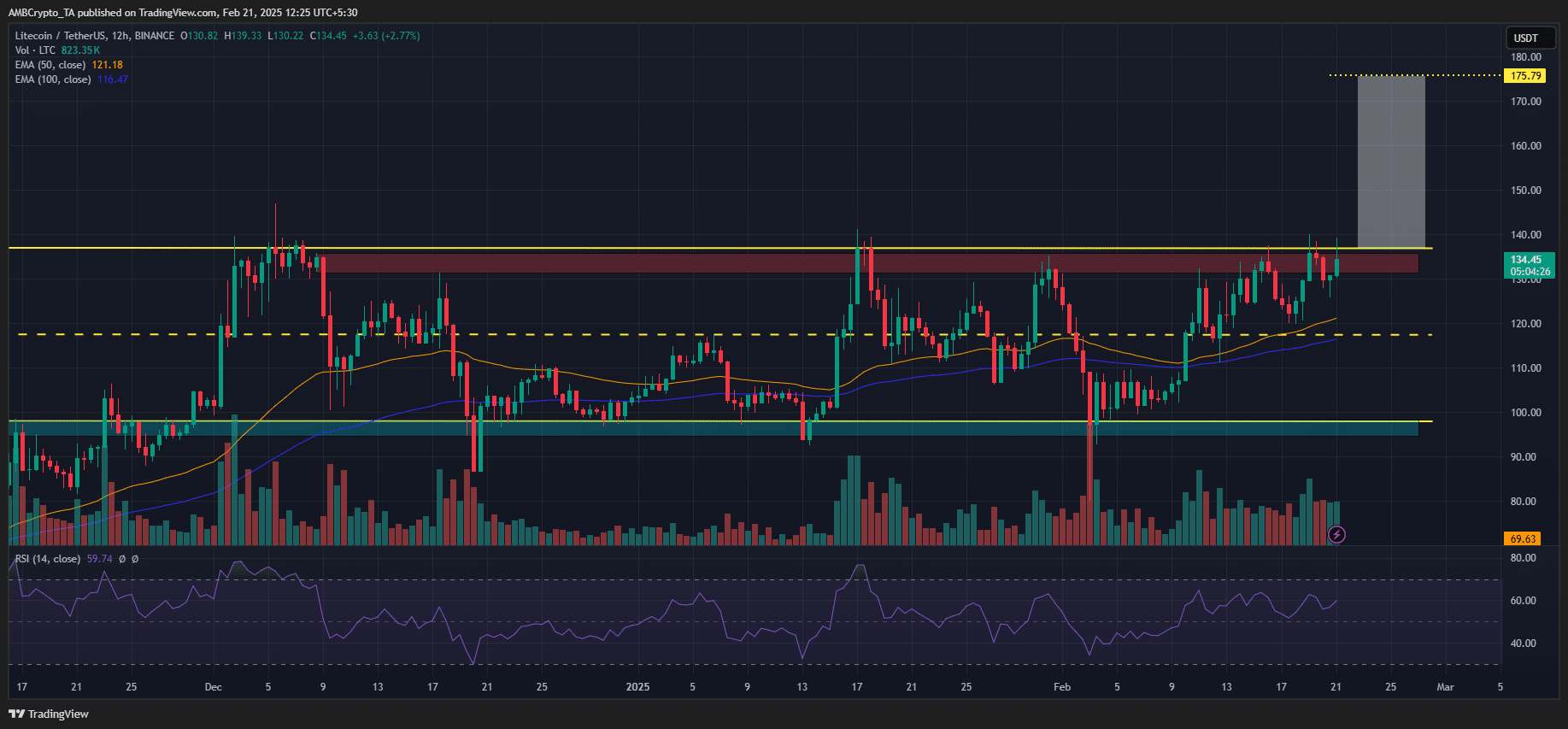

On the price charts, LTC was one of the few altcoins that held November gains. In February alone, the altcoin was up about 37% and valued at $134 at press time.

Source: LTC/USDT, TradingView

But the price action was at a key short-term supply zone and range-high. The Moving Averages and mid-range near $120 could act as buying opportunities if speculation continued.

However, a decisive breakout rally could push LTC to $175.

![Mantle [MNT] price prediction – Should you use price bounce past $1 to go short? Mantle [MNT] price prediction – Should you use price bounce past $1 to go short?](https://levishtech.com/wp-content/uploads/2025/02/Mantle-Featured-1000x600.webp-390x220.webp)

![Analyzing the odds of Helium’s [HNT] price falling below its 2024 low Analyzing the odds of Helium’s [HNT] price falling below its 2024 low](https://levishtech.com/wp-content/uploads/2025/02/HNT-1-1000x600.webp-390x220.webp)